Vacation rentals changing the face of neighborhoods

It’s a sunny day in the oceanfront community of Leleiwi, and Terry and Jayne Oliver of Butte, Mont., are strolling the lawn of their vacation rental.

It’s a sunny day in the oceanfront community of Leleiwi, and Terry and Jayne Oliver of Butte, Mont., are strolling the lawn of their vacation rental.

The couple, here for 10 days, use the tidy white house as their base as they travel the island, exploring its many attractions. They prefer vacation rentals to hotels, they said, because it’s a nicer atmosphere, it’s more relaxing and it includes amenities such as a kitchen.

ADVERTISING

“It’s more like a home,” Jayne Oliver said.

Just around the block, Native Hawaiian homeowners live along narrow, leafy Nene Street, which backs up to Keaukaha Homestead, a Department of Hawaiian Home Lands neighborhood. Here, friendly residents talk story with a reporter, but they don’t want their names used.

Are they bothered by all the newcomers and vacationers in their neighborhood?

An older man working on his yard pantomimes blinders, such as would be put on a horse. What’s the point, he asks.

“For us to talk about these things makes no sense,” the man said. “They coming, they coming, they coming and they’re not gonna stop.”

Longtime residents of Leleiwi, an 80-home community between Carlsmith Beach and Richardson Ocean parks about 5 miles from Hilo town, worry about gentrification of their laid-back little corner of paradise. Almost a quarter of the homes have been converted to, or are being used as, vacation rentals, estimates Stefan Buchta, a member of the Leleiwi Community Association.

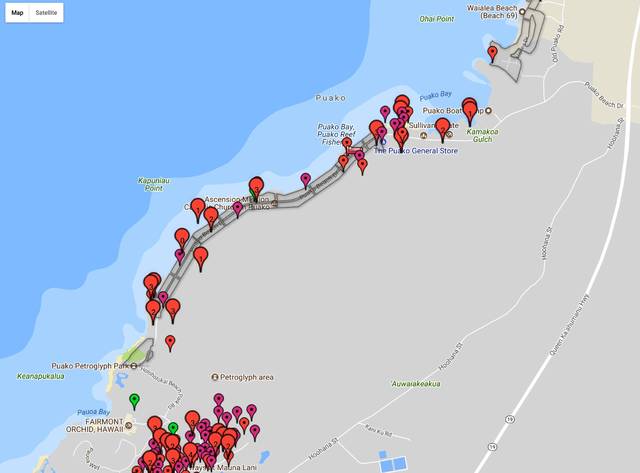

Across the island, the Puako community is experiencing a similar influx of vacation rentals. These are probably different from vacation rentals in other areas, said James Fritz, who rents out his home sometimes and lives in it other times.

The upscale community of largely part-time residents, where vacation rentals can go for $2,000 and up nightly, aren’t as likely to notice an influx of newcomers as would residents of long-established neighborhoods, he said.

But other formerly close-knit little communities all over the Big Island are feeling the impact of vacation rentals in their neighborhoods.

Some are taking a “if you can’t lick ’em, join ’em” approach, converting their own homes into vacation rentals, too. Some are bailing out, putting their homes up for sale.

Others hope the County Council can create regulations that stop the spread.

But owners of vacation homes already on the island, and their representatives, aren’t confident they’ll be able to continue operating, even with a grandfather clause. Those in residential and agriculture districts, especially, worry the county won’t give them a special certificate they’d need to stay in the business.

“If they denied my application for whatever reason, I would absolutely have to sell,” Heather Bandt, who lives in her Aloha Kona home four months a year and rents it out as a vacation home the rest of the year, said in an interview last month.

Zillow, an online real estate database, shows homes for sale in the neighborhood ranging from $425,000 to $684,000. Bandt said her family built their home, so it has a lot of sentimental value. But she needs to be able to pay her mortgage, property taxes and other expenses, she said.

Buchta has been compiling islandwide data for a presentation before the County Council when it takes up Bill 108, which would regulate vacation rentals. He said the bill has taken on a life of its own.

“People with vested interests are pushing back hard,” Buchta said. “But the longer we put it off, the worse it will be.”

Bill 108 would require existing transient vacation rentals outside of the Vacation District, the General Commercial District or Resort Nodes to apply for a nonconforming use certificate in order to be grandfathered in. Those in the allowed districts would be required to register with the county, but they don’t have to apply to the Planning Department for the special permit.

Short-term vacation rental is defined in the county bill as a residential dwelling where the owner or operator does not reside on the building site, that has no more than five bedrooms on the building site for transient use, and is rented to transients for a period of 30 consecutive days or less.

The bill doesn’t regulate so-called “hosted” rentals, where the owner lives on-site. Bed and breakfasts already are regulated by the county.

The county bill is on hold until after the Board of Ethics rules on whether North Kona Councilwoman Karen Eoff, one of the co-sponsors, has a conflict of interest because she owns a vacation condo in the Vacation District along Alii Drive. The board next meets March 19.

It’s not easy to get a grasp of how many Big Island homes are being used as short-term rentals, defined by the state as any rental of less than 180 days. Landlords who rent short term are required to register with the state for transient accommodations and general excise tax licenses and remit the required taxes to the state. It’s not known what percentage have done so.

Ross Birch, executive director of the Hawaii Island Visitors Bureau, used Hawaii Tourism Authority figures from its 2017 visitor plant inventory in a recent presentation to the County Council.

The tourism industry estimate of 8,647 advertised vacation rental units on the Big Island probably overstates the issue, as it includes duplicates from several vacation rental platforms. Buchta estimates the number to be closer to 4,859, deriving his information strictly from listings on Airbnb.

Airbnb is the third-largest vacation rental platform on the island, a company spokeswoman said.

It’s not known how many owners are paying the required TAT and GET. Owners of multiple units usually operate under one tax license, and tax information, other than the name and license numbers of those registered, is confidential. A 2017 survey by the tourism industry resulted in 2,037 Big Island rentals being voluntarily reported.

Bills in the Legislature would allow vacation rental platforms such as Airbnb to collect taxes on behalf of the landlord, strengthen counties’ ability to enforce zoning and land use laws, and make it unlawful for transient accommodations brokers to engage in business with operators that are not in compliance with all state laws and county ordinances.

They’d also give each county $1 million to set up a registration, property taxation and tracking system for vacation rentals.

Their future remains uncertain, however, as key bills were recommitted to committees on a deadline Friday and other bills moved forward. It’s said no bills are dead as long as the Legislature is in session, but it remains to be seen whether regulation will survive until the May 3 end of session.

“We’ve got to regulate this and that’s what we’re trying to do,” Mayor Harry Kim said. “It’s not just the impact to county services, but what it does to the lifestyle. You don’t put a store in a residential neighborhood, so why would you put any other commercial building?”

Richard Standke, who owns five of the vacation rental houses in Leleiwi and two others in Hawaiian Beaches, said the influx of new money brightens up neighborhoods, employs housekeepers and construction workers and creates quality housing.

“The taxes paid by tourists help support local government services,” Standke said. “New, beautiful homes make neighborhoods beautiful.”

Standke, who lives in Los Angeles, said vacation homes in the Big Island’s oceanfront communities don’t compete with local housing because land is “dirt cheap” on the island. There is plenty of room for lower-priced homes and rentals on the island, he said. He said his quality short-term rentals wouldn’t be used for longer-term rentals because he wouldn’t be able to recoup his investment. Other transient landlords have said they fear putting their property into long-term rentals because it’s so difficult to evict scofflaws.

“This is one of the nicest places on Earth to visit,” Standke said. “To rent it to one family is not a good use of oceanfront property.”

Close to Richardson Ocean Park, Koa Kealoha, another longtime local, offers a freshly cut coconut to Cindy Soto, who is visiting from Los Angeles. She’s touring the area in a dusty black pickup truck driven by one of Kealoha’s buddies.

Kealoha doesn’t want to see the neighborhood change around the one-story home he inherited. But he, too, acknowledges the inevitable.

“It’s going to happen,” Kealoha said. “You can surround me. Just surround me with love. If you surround me with hate, you’re going to get it back.”

Lounging in a lawn chair in his front yard with a beer and a cigarette and surveying the surf across the street, he smiles a slow, easy smile.

“This is the life,” he said. “You’ve got to live the life.”

Email Nancy Cook Lauer at ncook-lauer@westhawaiitoday.com.

Lying Harry taxes the people out of their homes and replaces residents with tourists that has money to burn then wants more demo rat regulation to further harm struggling residents. Further, lying Harry’s over tax and over spend agenda created this need to pay taxes and the cost of living that working families can not afford. Who are the dim wits that created this problem. Foolish demo rats are exterminating themselves and replacing themselves with visitors that can pay lying Harry.

Steve, there is a little secret: The majority of taxes generated by tourists sadly don’t stay on our island. This is not Harry Kim’s fault, he inherited a huge mess. This thing was also not created by “the democrats”, I assure you, because our democratic law makers (such as our senator Kahele) have been trying hard to fix it. I feel your pain and I am not happy about the proposed GET tax increases, either. But not everything is what it seems to be. Counties in Hawaii have less revenue raising authority than local governments do in most states. The U.S. Advisory Commission on Intergovernmental Relations (ACIR) observed in 1989, “Consequently, [Hawaii’s] counties are limited in their ability to initiate new functions.” Hawaii’s state government guards its taxing power jealously. Hawaii has 17 separate tax laws of which 14 are administered by the State; the counties administer only the local property tax, the motor vehicle weight tax, and the public utility franchise tax.

Kahele said give the proceeds to a racist organization called Office of Hawaiian Affairs. Another foolish demo rat that supports the disastrous demo rat agenda that has betrayed his constituents. Every darned demo rat is responsible for their over tax, over spend and racist agenda.

OHA is US based and has little transparency or accountability…looks like the fake state’s organization is more concerned maintaining itself than the Hawaiian nation.

I agree with your evaluation for it is the truth of the matter.

What a change of attitude Mr Kealoha, salivating at the chops with future equity gains? When the taxes are too high you will cash in an retire to gamble it all in Vegas? Leaving all the respect for the aina behind a f*ck aloha. Maybe Airbnb can finally put a hotel atop Mauna Kea? No defenders of the aina now, just hungry capitalists wannabes!

Rejoice you all, Stanke gets to decide that families don’t get to live by the ocean, unless it is on a tent.

I don’t know if it is Californians, but the proliferation of short term rentals are destroying residential neighborhoods especially in popular tourist areas. It is WRONG.

What a surprise, a person who owns 7 vacation homes on the island doesn’t understand how that displaces Hawaiians and local people. Part time housekeeping is a servant job–who wants to clean toilets for tourists? Land is not dirt cheap to people living here, esp when foreigners buy up land for speculation. There is an epidemic of youth suicides right now, few see a way to be able to afford to live here let alone thrive. If nothing is done to stop corporations and people from buying up land/houses for speculation, expect drug use, crime, violence, and suicide to continue to escalate.

I agree, most residents do not have the courage to tell it like it is. Thank you for standing up for the truth.

Glad someone is preparing to pump the brakes. I have worked with the poorest of the poor, providing psychiatric services, for 19 years here. Even as a professional, it is hard to make a living wage, with liw reimbursement and get on medical services. Its a shame that good, decent people are being forced out by greedy mainland/foreign prospectors, who neither know, nor love, the aina and it’s people. The regulations are needed and appropriate. We are not a third world nation, ripe to be pillaged by outside business interests.

Let’s find a way to limit the number of vacation rentals without destroying our island tourist economy. On the East side there are currently close to 7000 daily overnight visitors and 1000 hotel rooms. These tourist bring cash and tax dollars to every sector of our economy. Let’s limit the monster hotels and even limit the number that speculators can acquire in time. Destroying the whole industry as Bill 108 threatens to do won’t help.

Have you already looked at Bill 108? It simply limits vacation rental in residential- and Ag-zoned areas. It provides a way for some, but not all, vacation rentals to continue even in these areas. Compare this to most ordinances on the mainland which outright ban non-hosted rentals. Take Santa Monica and San Fran as recent examples. We actually have a lot of hotel buildings in properly zoned areas here on the East Side. They are empty, neglected, falling apart. For example, the Hilo Hotel on Kalakaua Park has been sitting empty for decades. Uncle Billies is boarded up. Many other such properties can be reactivated.

Limiting the number of vacation rentals doesn’t provide any relief for the unlucky homeowners who randomly end up living next to one.

Doesn’t the Constitution require equal protection under the law? Is it really okay to trample on the rights of homeowners so long as it’s not too many homeowners?

So why can’t the hotels be rebuilt?

The Puna Dustrict which is very large and spread out has hotels only in Volcano. The residential lots (almost all zoned ag) are for the most part large and houses are spread out; I don’t see any negative impact to neighbors from vacation rental properties. They are important in Puna for visitors and for those who own/operate them as there are virtually no jobs here. Just enforce the rules we have! Crack down on those who aren’t paying taxes and require a registration/license but don’t outlaw them and limit them to Banyan Drive!

As if there aren’t problems with crappy long term renters or even permanent resident neighbors. Frankly the vacation rentals near me cause me less trouble. The tourists are usually out touring the island and not even around most of the day; they don’t have barking dogs; and even the occasional obnoxious one leaves in a week. It’s the behavior that is important, not who the renter is.

true