How to arm yourself against identity theft, investment fraud and other financial scams is the focus of two “Scam Jam” sessions Tuesday, July 16, in Hilo.

The free morning and evening sessions are open to the public and co-sponsored by AARP, the state Office of the Securities Commissioner, the Better Business Bureau of Hawaii and the state Department of the Attorney General.

AARP Hawaii State President Gerry Silva said most people are more susceptible to falling prey to scam artists than they realize.

“With just a few simple pieces of information like a credit card number and a password, they’re able to assume the lives of their victims without us realizing it — until the damage is done,” he said.

Lisa Nakao, operations director for BBB Hawaii, said the Federal Trade Commission reported that in 2014, government agencies reported 1.5 million fraud-related complaints nationwide, with 5,957 of those filed by Hawaii residents.

“People lost $1.7 billion dollars total in 2014 (nationally),” she said.

Jackie Boland, AARP’s community outreach director, said part of the two-hour seminars will be spent on “persuasion tactics that con artists use to get people to part with their money.”

“We worked with the FBI and sifted through about 500 tapes to figure out what the key tactics that con artists used, and those tactics were put into this piece of this presentation called ‘The Con Artist’s Playbook,’” she said. “We talk about the tactics and we give the audience a chance to see the tactic used and see if they can identify what persuasion technique is being used.”

Boland said AARP participated in a recent statewide teleforum on scams with about 1,000 callers, “and a lot of the questions came from the east side of the Big Island. People were talking about the Microsoft scam.”

Boland said the scam includes someone calling, saying they’re from Microsoft and they can fix computer crashes by directing the victim to a website where they take control of the victim’s computer, download personal information, plant a virus on the computer, and then charge the victim to remove the virus.

“We are telling people to never allow somebody calling you access to your computer and never give somebody on the phone your personal information,” she said. “They may claim to be from a respected institution, but you need to then call them back on another number than you know, not a number that they’re giving you on the phone.”

Theresa Kong Kee, investor education specialist from the state Office of the Securities Commissioner, said FBI figures from 2013 indicate Ponzi schemes “are the No. 1 investment fraud in Hawaii.” Those schemes usually start by offering investors unusually high returns, and the operators pay investors from capital from new investors, rather from profits earned by the business.

Examples include former Maui accountant Lloyd Kimura, who was sentenced to 11 years in prison for a 24-year-long Ponzi scheme that bilked investors of an estimated $20 million, and Roberta “Buddy” Wong, a Hilo woman who was sentenced to federal probation in 2013 for a decade-long scheme prosecutors said netted about $475,000.

“We probably have close to 90, 100 cases right now statewide. These types of frauds, when you wipe out people’s life savings, it’s really hard to recoup the money,” Kong Kee said. “If you’re hit by a credit card scam or bad check, those are smaller amounts.”

Kong Kee advises those who have investments through a broker to “check to see if the person’s registered” to sell securities.

“If you think you’re a victim, report it and do it as soon as you can, and we can help you through the process. Don’t wait,” she said.

She said people can search brokercheck.com to get information about a broker or investment company from the Financial Industry Regulatory Authority, or FINRA.

That advice was echoed by John Kai, president of Pinnacle Investment Group in Hilo.

“I suggest that people, before they come see me, Google us,” Kai said. “Google ‘Pinnacle Investment Group,’ Google ‘John Kai’ and see what you come up with. If you have any questions as it relates to what you found or any concerns, bring them to me when we get together.

“You can also do a check on your broker through FINRA’s Broker Check. The only challenge with that is that FINRA does not update (regularly). It’s a regulatory body. … That’s why I say Google first. Google is in real time.’”

Angela Kaiwikuamoohoihou, a crime prevention specialist for the state Attorney General’s office, said her presentation will focus on identity theft and charity fraud.

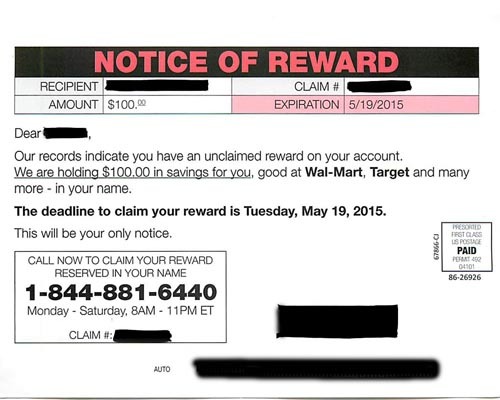

She said advance fee fraud, where scammers ask for money upfront with a promise of a prize, money, goods or services for a fee — the victims never see their money or hear from the scammers again — is a popular scheme among con artists. Also on the rise are rental fraud schemes, where an overly attractive “rental” opportunity is put online.

“There are fake applications that are posted on Craigslist ad,” she said. “People apply for them; they supply their personal information. No one gets back to them. And someone has all that personal information.”

Kaiwikuamoohoihou also noted charity scams, such as the one in which four national cancer charities — The Cancer Fund of America, Cancer Support Services, The Children’s Cancer Fund of America and The Breast Cancer Society — are accused of swindling donors nationwide, including Hawaii, out of millions of dollars.

Concluded Boland: “Because we have so many partners working on it, we’re pretty much covering the depth and breadth of fraud and scams.”

Email John Burnett at jburnett@hawaiitribune-herald.com.

Scam Jam sessions on Tuesday, June 16

9:30-11:30 a.m.: Hilo Naniloa Hotel Polynesian Room. Online registration: https://aarp.cvent.com/morningscamjam6-16

5:30-7:30 p.m.: Hawaii ADRC Training Room, 1055 Kinoole St. Online registration: https://aarp.cvent.com/pauhanascamjam6-16

Or call toll-free 1-877-926-8300 to register for either session.