West Hawaii pays bulk of island’s property taxes

If West Hawaii property owners feel sticker shock when they open their tax bills, they may have good reason.

ADVERTISING

West Hawaii’s three council districts — home to a third of the island’s roughly 186,000 population — will be shouldering more than two-thirds of the property tax burden this year. That’s according to a West Hawaii Today analysis applying current tax rates to certified property values released Tuesday by the county Department of Finance.

Property tax revenues across the island went up by $19.5 million, a 7.9 percent increase, because of the increase in property values. There was no tax rate increase contemplated in the proposed $462.7 million budget submitted March 1 by Mayor Billy Kenoi.

The property value increase is literally hitting home for North Kohala resident Kevin Conway. His home, previously valued at $425,000, is increasing in value by $104,000, a 24.5 percent hike. That’s raising his taxes another $850 annually, he said.

“I was appalled when I saw the raise in my assessment,” Conway said Friday. “It was a shock.”

Conway said his neighbors are in a similar predicament, with one neighbor reporting a $240,000 increase in valuation.

“A lot of people don’t look at their individual assessments,” Conway said of the annual mailing that’s marked “this is not a bill — do not pay.”

“When they get their tax bill, they’re going to hit the roof,” he added.

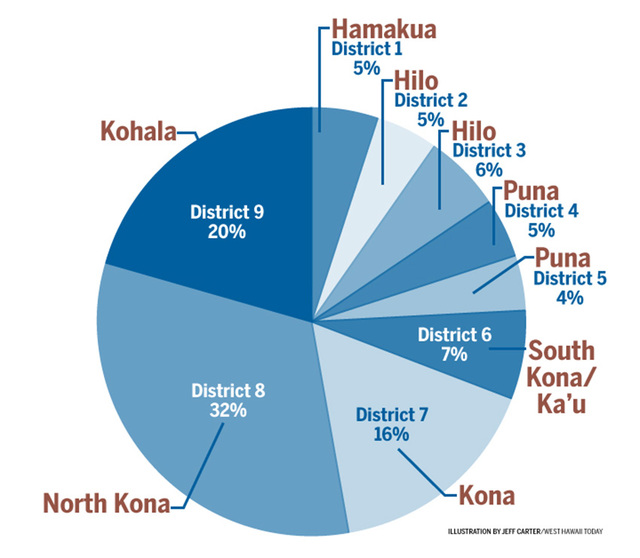

The newspaper’s analysis shows North Kona District 8 with the highest property tax burden, carrying 32 percent of all property taxes paid on the island. That’s followed by Kohala District 9, with 20 percent and Kona District 7 with 16 percent.

West Hawaii’s districts 7, 8 and 9, the only districts with a double-digit tax burden, together account for 69 percent of all property taxes paid on the island.

The other end

At the other end of the spectrum is Puna District 5, with 4 percent of the property taxes on the island. Hamakua District 1, Hilo District 2 and Puna District 4 each contribute 5 percent.

The newspaper did the analysis by aggregating by council district all net property assessments and applying the current tax rates and proposed tax rates for each of the nine property classes within each district.

The mayor has until Thursday to submit a revised budget to the County Council, which has until June 20 to establish tax rates. The budget year starts July 1.

Kenoi said in a text message Saturday there would be no tax increase this year. The budget is balanced without it, he said.

The analysis found that North Kona’s District 8 will pay about $85.3 million, Kohala’s District 9 will pay $53.9 million and Kona’s District 7 will pay $43.5 million of the approximately $264.6 million tax base under the proposed rates.

In contrast, Puna’s District 5 will pay the lowest, $10.9 million, Puna’s District 4 will pay $11.9 million, Hilo’s District 2 will pay $12.9 million, Hamakua’s District 1 will pay $13.5 million, Hilo’s District 3 will pay $15.4 million and South Kona/Ka‘u’s District 6 will pay $17.3 million.

Puna Councilman Danny Paleka said his district may contain the lowest property values, but it’s full of residents needing services from their county government. They shouldn’t be shortchanged based on their tax contributions, he said.

“That’s certainly something that I’m trying to change,” Paleka said of what he sees as real needs for his district.

In particular, he’s been pushing for a better bus system, road improvements for the limited accesses in and out of Puna and improvements to Herbert C. Shipman Park.

“The numbers don’t lie,” Paleka said. “Our property values are low. We live in cheaper type of houses and maybe unpermitted. It depends where you want to live. We live in the most beautiful place.”

Billing due, appeals up

Tax bills will be mailed July 20.

Property assessment notices were sent out in late March and property owners had only until April 9 to file an appeal. Conway is one those appealing.

As would be expected, appeals are up as well. The number of appeals increased 61.6 percent to 362, and the amount pending in the appeals increased 66.9 percent to $180.7 million, said Deputy Finance Director Lisa Miura.

Appeals are heard by the Tax Board of Review, a five-member board appointed by the mayor and confirmed by the council.

In addition to the value of the property itself — West Hawaii properties in general have a higher market value — factors that play into determining tax values include various county exemptions and new construction that raises property value.

Of the estimated $244.4 million gross value for new residential construction and $29.1 million gross value for new commercial construction, a full $98.9 million is construction in District 8 and $42.9 million is in District 9, according to Finance Department data.

When new construction is taken out of the mix, property value increases over last year range from 2.8 percent for District 5, Puna, to 9 percent for District 8, North Kona.

Reasons for raises

Property values may increase in a neighborhood if there were a number of recent comparable sales to aid in evaluations, Miura said. She said a lull in property purchases, followed by a surge as the economy came out of the recession, could increase property values more than in recent years.

Assessed values for properties in the homeowner class and affordable rental class, not including any improvements, are capped at 3 percent annually until the property changes hands. So districts with a lot of longtime homeowners rather than those who have second homes in Hawaii would see less of an increase in value.

Property exemptions for homeowners also play a role. Homeowners receive an exemption of $40,000. Homeowners aged 60 to 69 receive an $80,000 exemption and those 70 and older receive a $100,000 exemption. Additional exemptions apply for the disabled and disabled veterans.

As expected, districts with the lowest taxes also had the highest percentage of exemptions. A full 27.5 percent of property value in District 5, Puna, is exempted from taxes, compared to 7.3 percent in District 8, North Kona.

Hilo District 3 Councilman Dennis “Fresh” Onishi said his district has one of the lowest tax burdens because it’s composed primarily of established homeowner neighborhoods, and many of the homeowners are older.

“In my district, the neighborhood is older. We have homeowners who have been owning their homes for 40 to 50 years, who’ve been living there their lifetimes,” Onishi said. “Other areas, they have people who are just moving in.”

One of those areas is North Kona’s District 8, a district with a high concentration of hotels and resorts as well as second homes. Those categories not only pay higher tax rates, but they also don’t qualify for exemptions that lower the property values.

The mood in West Hawaii has changed dramatically over the past five years or so, said North Kona Councilwoman Karen Eoff. It wasn’t that long ago that residents were clamoring for West Hawaii to break off and become its own county, because of public sentiment that the region was providing most of the tax revenues but getting very little in return.

It’s different now, Eoff said. Big county projects such as the West Hawaii Civic Center, the Ane Keohokalole Highway and — less glamorous but equally important — the Kealakehe Wastewater Treatment Plant have all contributed to residents feeling they’re not being neglected, she said.

“There was an outcry, and there was an answer,” Eoff said.

While County Council members look out for their own districts, they also take a countywide approach, she said. Puna, for example, doesn’t have a huge tax base, but it has a growing number of people in need of basic services.

“I believe that we should look at the island as a whole,” Eoff said.

Email Nancy Cook Lauer at ncook-lauer@westhawaiitoday.com.