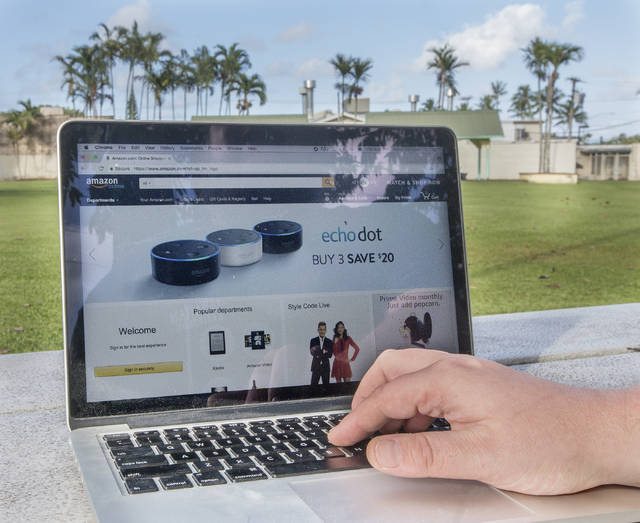

Hilo resident Terra Carden uses Amazon frequently — and for just about everything. ADVERTISING Hilo resident Terra Carden uses Amazon frequently — and for just about everything. Speedy shipping coupled with access to unlimited varieties of electronics, jewelry and other

Hilo resident Terra Carden uses Amazon frequently — and for just about everything.

Speedy shipping coupled with access to unlimited varieties of electronics, jewelry and other goods is hard to pass up.

Starting Saturday, however, Carden’s Amazon purchases are going to get a bit more expensive as the Seattle-based, online retailer begins collecting tax on all items sold in Hawaii.

Amazon announced the tax earlier this month. It will amount to 4.5 percent for Oahu shoppers and 4 percent for those on the neighbor islands.

“It (will) definitely deter me,” Carden said. “(Shipping) already takes longer here and there’s already so much tax here that after upping it, I’m not even getting a deal anymore.”

The decision, though bemoaned by local consumers, was lauded by the state’s retail merchant industry which says the tax will help remove Amazon’s competitive edge over storefront businesses that are required to pay Hawaii’s general excise tax.

Amazon has not disclosed why it decided to start collecting, but Tom Yamachika, president of the Tax Foundation of Hawaii, surmises the company is facing growing pressure from lawmakers throughout the country, including in Hawaii.

Hawaii law doesn’t currently require companies without a physical presence in the state to pay the GET. Lawmakers are considering a bill, however, which would require those that generate at least $100,000 in sales per year in Hawaii to begin doing so.

Other states are considering similar legislation, Yamachika said. Amazon also will start collecting taxes Saturday in Idaho, Maine and New Mexico for a total of 45 states.

“There are many states which have gone down the path of asking for companies to comply with the sales tax as long as they are selling a large amount of merchandise in the state,” Yamachika said. “And I think Amazon is kind of looking at that and thinking, rather than fight it out and spend money in that process, they can just settle with the states now and let the fighting be done by other (online retailers).”

Hawaii consumers technically are supposed to pay a “use tax” on items purchased from out of state, but most never do, Yamachika said. A 2012 University of Tennessee study showed the state loses about $120 million per year in uncollected use tax.

Revenue from the Amazon tax alone could bring an additional $11.1 million per year to the state’s coffers, according to a January 2016 study by research firm Civic Economics. That’s based on data that showed Amazon sold more than $255 million worth of retail goods in Hawaii in 2015.

The tax garnered support from Tina Yamaki, president of the Retail Merchants of Hawaii, who said she hopes to see more online retailers follow suit.

Yamaki said the tax removes Amazon’s “unfair advantage” over storefront companies. Hawaii doesn’t have a sales tax, but the GET typically is passed on to consumers when they make purchases.

“It’s leveling the playing field, especially for brick-and-mortar stores,” Yamaki said. “When you’re buying from Amazon, you’re not buying from the aunties and uncles who actually work in the retail stores and we’ve been seeing more and more people buying online. So with Amazon starting (to collect) the tax, it’s a step in the right direction.”

Some Hilo residents disagreed.

Jeff Butterfield called the new tax “irritating” and speculated the “state is always looking for more ways to get money.”

Brittany Lockaby, who said she has been considering an Amazon Prime membership (which grants unlimited free shipping after paying a yearly fee), said she’d have to think about it some more.

“It’s not huge but it still makes a difference, especially on big items,” Lockaby said. “That would definitely make it less cost effective for sure.”

Kainoa Lee said he thinks Amazon should counter the tax by adding new deals for Hawaii shoppers as incentives to continue using the website.

“The cost of living is already high and you’re just adding to an already high cost of living,” Lee said. “I think I’d still use it, they have some great stuff. But anytime you add to the price, you’re going to effect the consumer. It’s going to be a negative thing in general.”

Email Kirsten Johnson at kjohnson@hawaiitribune-herald.com.