Mayor Harry Kim on Friday sent the County Council a bill to raise the general excise tax by one-half percent to balance next year’s budget, while telling a state legislative panel that the county exhausted its fund balance to pay for this year.

Kim told state lawmakers the county took $20 million from last year’s leftover money, leaving just $89,000 in its fund balance while costs continue to rise for payroll and other county expenses. That’s despite hikes in property taxes and fuel taxes approved last year by Kim and the council.

“It was very clear that what I had to do as an elected official, the thing we hate to do, and that is raise taxes,” Kim told the panel in Honolulu.

The mayor added he was “damned embarrassed” on reading the morning’s newspaper and seeing he got a raise. Kim’s $30,581 raise was among big raises approved by the Salary Commission for 33 top officials.

The Legislature gave the counties authority to raise the general excise tax, or GET, provided they have an ordinance in place by March 31. It’s estimated to raise anywhere from $25 million to as much as $40 million for Hawaii County annually. So far, only Honolulu and Kauai have done so.

Council to

vote on GET

Even as Kim blasted the GET hike as hitting poor people the most, his finance director sent the council a bill raising the tax.

“At this point, I don’t know whether I will push for it, or support it, but I will leave it open,” Kim told the panel. “The excise tax is the worst regressive tax. We’re taxing again the people who can least afford to pay taxes … they pay more.”

Kim was responding to Sen. Lorraine Inouye, D-Hilo, Hamakua, Kohala, North Kona, who asked why the county hasn’t taken advantage of the tax revenue opportunity provided by the Legislature.

“They ask us to help them and my suggestion is to go ahead and raise taxes,” Inouye said about county officials.

Kim told the panel that costs outside his control continue to rise. Thanks to recent collective bargaining agreements at the state level, employees’ salaries and benefits now account for 62.5 percent of the $491 million county budget, he said.

Payments on bond issues from prior years account for 12.5 percent. A state-mandated increase in post-retirement benefits other than pensions, known as GASB-45, will bring next year’s county contribution to 15.35 percent of the general fund, compared to about 6 percent in 2006.

Hawaii County voters also passed a charter amendment that takes 2 percent of property tax revenues off the top to purchase land for preservation. An additional 9.25 percent is taken to maintain those lands.

Mayors seek

taxing authority

Kim, along with the other three county mayors and representatives from all four county councils, asked the Senate Ways and Means Committee and House Finance Committee to restore previous allocations of the transient accommodations tax — collected on hotels and lodging of less than 180 days — to give the counties a greater share.

County mayors also asked the Legislature to give it more broad-based taxing authority, through HB 1664.

The bill states, “Each county shall have the power, by ordinance, for general revenue purposes, to levy, assess, and collect, or provide for the levying, assessment, and collection of taxes, including surcharges on taxes imposed by the state, as each county shall determine on persons, transactions, occupations, privileges, subjects, and personal property located within its geographical limits, and upon the transfer of real property, or of any interest in real property situate within the county levying and assessing the tax.”

HB 1665, part of the mayors’ legislative package, would give the counties 55 percent of TAT collections, with the state getting 45 percent. That could mean as much as $200 million for the counties to share, an amount that would increase as tourism increased. Currently, the counties share $103 million of the approximately $450 million collected each year, with Hawaii County getting $19.2 million of that.

The TAT no longer is the county’s second-highest source of revenue. Property taxes account for about 74.5 percent of this year’s general fund revenues, compared to 4.3 percent for TAT. An additional 5 percent was drawn from the fund balance, and licenses and charges for services accounted for 6.1 percent.

The GET can be used only for roads and mass transit, but using that money could free up funds for other projects.

Council Chairwoman Valerie Poindexter, contacted in Honolulu where she also was attending the money committees hearing, wasn’t thrilled with the GET bill. But it will be added to an upcoming council agenda.

“I still believe that the GET tax is a regressive tax. There should be a way to incentivize this tax for the poor, disabled and elderly through exempting food and health care expenses,” Poindexter said. “(I’m) looking forward to hearing from the public and having a lengthy discussion with my colleagues.”

‘We have to

face reality’

Managing Director Wil Okabe said Kim is reluctant to raise the GET, but “we have to face reality and look at our revenues.”

Okabe lays the responsibility for the county’s tight budget at the feet of the Legislature. If the state hadn’t taken such a large chunk of the TAT, the county wouldn’t be so financially stressed, he said.

“It all circles back to what the Legislature did,” Okabe said. “The constituents on this island have to be aware of the ramifications of what the Legislature does.”

Deputy Finance Director Nancy Crawford said the fund balance has been this low before, but it’s still a concern. The county administration is formulating its budget for the fiscal year that starts July 1 and has until March 1 to present a preliminary spending plan to the council.

The county also has a budget stabilization fund of about $6.3 million still in reserves, she said.

“We know we will get some amount of fund balance this year, but we’re going to be very careful,” Crawford said. “The sky isn’t falling, but it is a concern.”

Kim described for the panel the impoverished conditions in Puna — the fastest-growing district in the state — and Ka‘u, where most if not all students are on free and reduced lunches and residents lack basic infrastructure such as county water.

Kim said the state needs to help, especially with the growing homeless problem.

“I can live with not too good roads. I can live with not too good parks,” Kim said. “But it is sure as hell hard to live in a community that is laden with poor people having a very, very difficult time.”

Email Nancy Cook Lauer at ncook-lauer@westhawaiitoday.com.

Can you at least fire the people that don’t deserve to get paid.

I mean relative to actual performance and results.

or have the word Babysitter added to your business cards.

Better know who your voting for. Or it could cost you a lot of money. What an expensive joke.

The ugly truth about demo rats. They are all a bunch of lying thieves. More worse the demo rats that elected these bandits are stuck on stupid. Tough times are caused by demo rats. May they all rot in hell.

So move to a red state..I bet I could get people to pitch in to buy you a ticket outta here. Nothing worse than grumpy old white dudes with resting dick face, walking around looking miserable. I have a neighbor like you, we all call him “bitch” cuz that’s all he ever does….

The last major recession was caused by a Republican, and the one before that. Obama pulled us out of the last one that almost became a depression. When this stock bubble bursts and inflation and recession hit you’ll probably blame it on the Democrat that takes Trump’s place in 2020.

Progressive-fascists and the crony Democrat Party will bleed us dry.

Their nomenklatura will always be coddled.

Meanwhile, any kid with a brain leaves wen grad, and don’t come back, as there ain’t no opportunity in Hawaii no more.

Parents loose their kids, but keep voting for these Dem parasites anyway.

Sad. Predictable.

I was about to say this is insane, but we are led by a dimented old fart and a bunch of old retired never was and wanna be Managing Director who can’t find his a*% if he had help.

Lets see the County gets RAISES and the Increased GET taxes drive away Our Touring visitors.

It is called

KILLING the Golden Goose.

Very sad leadership without vision .

This is not going to end well when Our representatives and employees fill their pockets at everyone else’s expense.

It certainly reasonable for one to consider the way and means to rid Hawaii Island of these fool’s over tax and over spend agenda. There are solutions. One being that Hawaii Island to succeed from the State of Hawaii and become the 51st state. This would dispose of an unsustainable demo rat agenda that exports thousands of local families yearly. Pigs at the trough with their mouths full while grinding poverty and rampant crime in Puna is the result of an unstainable demo rat agenda. In fact it is absurd!

Hilarious! You sound like Texass.

Steve and Keoni need to go back to high school and learn standard English. Mastering a language enables one to form and evaluate concepts. If their statements weren’t so incoherent I’d almost think they were Russian trolls.

Talk about sad.

This is what happens when you have a single party state and county. County is supposed to be non-partisan, but they never met a tax they didn’t like, and never reduced the size of the county government, as everything they do is “vital” and unquestionably so. Sounds like Venezuela like conditions are our future.

I’ll accept a raise in the GET If and only IF you eliminate all GET on food, consumables and medicines, cut county worker count by 10%, and privatize the public transportation system.

yeah, taxing groceries is lame.

Take it out of your 36% increased allowances, and take a lesson from history: until WW2, when Hawaii County ran out of money, the local government SHUT DOWN, often for months at a time, until their spending house was in order again. Harry Kim cannot be too young to remember that.

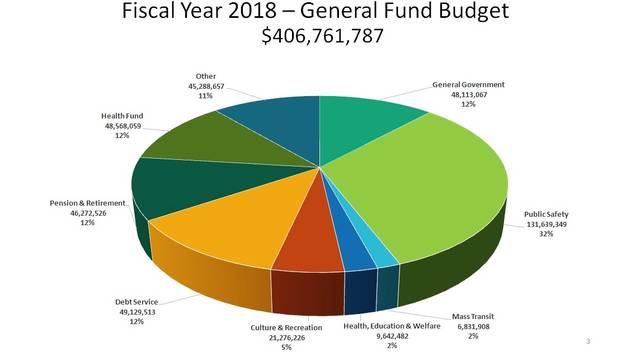

48% of that pie is just cost of raises and government perks and we owe 48million to debt on what, hopefully not related to employee retirement and other bennies. And the County only spends 2% on health, education and welfare and 2 1/2 times that much on parks and recs. Public Safety gets a third of the yearly budget.

Any fresh face who wants to get elected only needs to commit to (a) abolishing the Salary Commission; (b) reducing government salaries; (c) increasing government accountability; and (d) reversing all of these increased taxes imposed by the current regime. I can’t promise that really, but I can promise you that no politician who raised any tax that I am paying is getting my vote come next election. I don’t care who the other guy is, if you raised my taxes the other candidate gets my vote. I hope the Tribune-Herald make sure to publish a list of all of tax-loving politician so people are at least reminded who it was that took food out of their mouths.

Why is Nancy Cook Lauer only showing us the “oh poor me” general fund budget? Why didn’t she get the WHOLE operating budget that includes the highway fund, which should be on F after Harry Kim hiked the gas tax. And Harry obviously isn’t spending it, because look at our roads.

nothing is going to happen….nothing……