Surprise bill giving neighbor islands greater TAT share alive and advancing

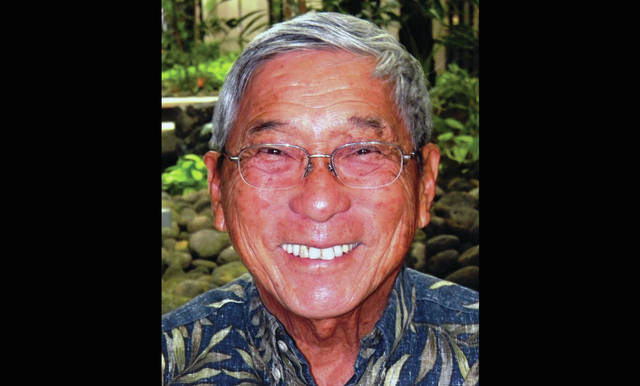

KAILUA-KONA — Hawaii County Mayor Harry Kim was taken aback after he received a call Tuesday night from House Speaker Scott Saiki asking him to testify on a measure to increase the county’s share of the Transient Accommodations Tax by more than $12 million annually for at least the next dozen years.

KAILUA-KONA — Hawaii County Mayor Harry Kim was taken aback after he received a call Tuesday night from House Speaker Scott Saiki asking him to testify on a measure to increase the county’s share of the Transient Accommodations Tax by more than $12 million annually for at least the next dozen years.

Kim was even more pleasantly surprised Thursday when the legislation, Senate Bill 648, sailed through the House Committee on Finance, passing unanimously with amendments.

ADVERTISING

“To tell you the truth, this was so quiet that Tuesday was the first I’d heard of it,” the mayor said. “I really believed they’d shut the door on us last year because they said a $103 million maximum (to split among neighbor islands) in perpetuity.”

“That’s like saying don’t bother us,” Kim continued. “Obviously, I was wrong.”

The bill would increase Hawaii Island’s share of TAT revenues from $19.1 million to $31.2 million annually. It would also bump Kauai’s portion up nearly $9.5 million yearly and increase Maui’s share by just a shade under $15 million. The amount afforded to the City and County of Honolulu would remain unchanged.

Hawaii County’s financial situation was already stressed when Kim assumed office a little more than one year ago and the proposed budget for the upcoming fiscal year is expected to increase by around $25 million over the last, cracking the half-billion mark for the first time in history.

Collective bargaining increasing salaries and benefits for public employees, which occurred primarily at the state level, bumped this year’s budget tab up nearly $13 million. The Salary Commission also doled out several raises to high-ranking county officials, adding another $1.5 million.

In response, Hawaii County hiked property taxes and fuel taxes last year. Kim said the notion was as disconcerting as it was necessary, as property taxes now account for 72 percent of county revenue.

Kim sent over a revised budget to the County Council earlier this week full of deep cuts to homeless initiatives and other social programs, as well as several other projects.

“They were dramatic, and I mean dramatic, cuts,” Kim said.

An extra $12 million yearly would go a long way toward bolstering the Village 9 homeless project in Kailua-Kona and its companion project in Hilo, Kim said.

It will also potentially save smaller initiatives like a program to help spay and neuter the county’s growing feral cat population and keep alive a joint county/state effort to combat destruction wrought by invasive albizia trees.

“Obviously, it’s a tremendous, tremendous boost as far as our budgetary problems,” Kim said.

Rep. Nicole Lowen, D-Kailua-Kona, sits on the Finance Committee and said she expects the bill to receive widespread support, even from Oahu representatives, when it heads to the House floor for a vote.

As to why the Legislature became suddenly amenable to the idea of granting a greater share of the TAT to neighbor islands, gifting around $36 million annually out of the state budget, Lowen explained much of it had to do with the special session in 2017.

During that session, legislators raised the TAT by 1 percent statewide to pay for Oahu’s ailing rail project — a move widely perceived as Oahu-based lawmakers strong-arming their neighbor island counterparts into bailing out the over-budget project.

“I think a lot of us neighbor island representatives were frustrated with how things went down during special session, and there wasn’t a lot of time to discuss things,” Lowen said.

“There were a lot of issues that arose that we didn’t have time to deal with.”

“This, I think, rectifies that a little bit,” she added.

Also helpful was that SB 648 didn’t increase the share of the TAT heading to the City and County of Honolulu, which keeps the price tag on the move considerably lower.

Lowen guessed that a recent economic forecast from the Council on Revenues estimating an improved financial situation in Hawaii may have influenced lawmakers as well, leaving them more open to sharing the TAT wealth with counties.

“We’re all serving the same people and there’s a growth in tourism on neighbor islands … and a lot that has to be paid for,” Lowen said. “Hopefully this can be the start of a bigger conversation looking at all our sources of revenue and the tax system and figuring out where revenue can be generated in a way that’s going to be least harmful to local residents that can least afford it.”

The general excise tax is widely considered one of the most, if not the most, regressive tax in Hawaii, disproportionately impacting its lowest-income residents. Kim has proposed an increase to Hawaii County’s GET of 0.5 percent, which is currently being considered by the County Council.

Kim said he will not rescind the proposal because, as Hawaii County Managing Director Wil Okabe explained, the TAT measure “is not a done deal,” and the time limit on bumping the GET may expire before a TAT increase would be made official.

The state afforded counties the option to raise the GET during the same special session in which legislators raised the TAT.

GET revenues are only available for operating or capital costs for public transportation, meaning the roughly $25 million the 0.5 percent bump would generate annually could be used for highway projects or to aid the county’s beleaguered mass transit system.

“I’ll keep pushing that,” Kim said. “I know it’s a difficult hill to climb, but I feel it’s that important.”

TAT revenues are not subject to such stringent restrictions as those from the GET and can be used to fund any project under the county’s general plan, development plan or tourism strategic plan.

The GET hike would sunset in 2030, the same year as the TAT. Both would likely merit discussion for continuation, as is common with laws that generate substantial revenues but are subject to expiration dates.

In the meantime, a GET increase in Hawaii County could bolster initiatives rendered considerably more viable if the TAT increase makes its way through the Legislature.

SB 648 will have to pass second and third readings in the House before heading back to the Senate. Lowen said if the Senate moves the bill through without adding amendments, it would head directly to the governor for his signature.

If amendments are added, the bill would head to conference committee and a draft would be produced for consideration in both chambers. If such a draft passed, Ige’s signature is all that would stand between the TAT reform and becoming law.

Email Max Dible at mdible@westhawaiitoday.com.

Demo rats are taxing the tourist industry to death and now they are taxing residents out of existence. Lying Harry could care less about either and is hell bent on destroying hard working families trying to make ends meet, the fat cat demo rats like Kim are flush with taxpayer dollars while families can not afford lunch for their children. The demo rats are clearly stuck on stupid and that includes the fools that voted to exterminate themselves.

I have given testimony against a GET increase. If Democrats really cared about you

they would drop the GET on food, drink, and medicine. But Democrats

only care about their narrative and the party.

Most Hawaiian voters are to stupid to figure that out.

Meanwhile HB584 is working its way through Senate–it Exempts Pepe’ekeo’s Hu Honua Bio-Energy from paying any GET. This weekend is chance to send in testimony.

Wonderful! It will allow Kim to raise salaries and pensions for him and his 89-day hire cronies, and keep the other tax increases on the rest of us in place. Heckuvajob, Harry!