Editor’s note. This is the second day in a 2-day, 3-part series looking at the bevy of fee and tax hikes everyone is expected to pay.Today focuses the state increases, utility increases. Sunday’s story focused on County increases.

Since Hawaii County is by far the poorest county in the state, residents here feel a harder squeeze from most state taxes than do residents of other counties.

In 2017, a full 15 percent of Hawaii County residents lived in poverty, compared to 10 percent on Maui and Kauai and 8 percent on Oahu, according to estimates released this month by the U.S. Census Bureau for use in determining school funding.

The poverty line for educational programs is set this year at $13,960 annually for one person, $18,930 for two, $23,900 for three and so on, to $48,750 for a family of eight.

Hawaii County’s estimated median household income in 2017 was $56,540, compared to $80,947 for Oahu, $74,881 for Kauai and $76,376 for Maui. The median means half the households make more and half make less.

That’s an increase of 3.4 percent over the previous year, when Hawaii County’s median income was estimated at $54,684.

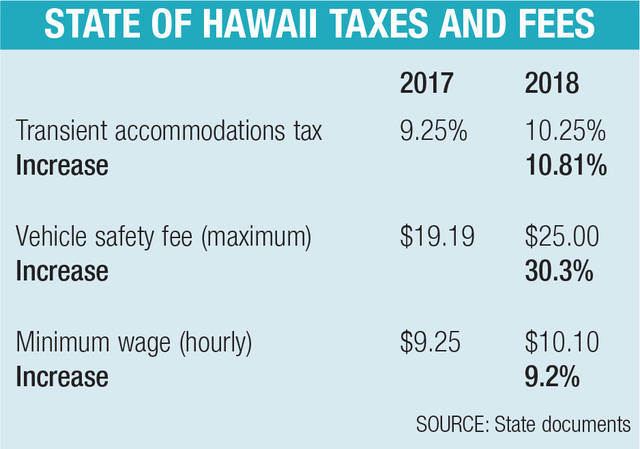

Those at the lower end of the spectrum are more likely to feel the negative effects of fixed tax amounts such as flat increases in general excise taxes, fuel taxes and vehicle registration fees. On the bright side for those residents, the minimum wage went up to $10.10 per hour in 2018, a 9.2 percent increase over 2017.

Few state taxes went up this year, although Hawaii County residents on Jan. 1 will start paying a county-imposed one-quarter cent surcharge on the state general excise tax.

Statewide, motor vehicle owners face an increase in safety inspection fees, with the maximum price rising from $19.19 to $25, a 30 percent increase.

The increase went into effect Sept. 13. From this fee, the Hawaii Department of Transportation receives $1.70 per vehicle toward the cost of the program, said an HDOT spokesman.

Gov. David Ige, presenting a conservative budget plan this year, said any discussion of tax and fee increases would come after he submits his legislative package to the Legislature, where the regular session starts Jan. 16.

Although state lawmakers discussed a bevy of bills that would have raised taxes and fees, none passed except a constitutional amendment that would have imposed a state tax on investment property. The Hawaii Supreme Court struck that measure from the ballot, saying it was too vague.

But an equally controversial tax passed in a 2017 special session hiked the transient accommodations tax on hotels and short-term rentals to 10.25 percent from its previous 9.25 percent as of Jan. 1, 2018, with the proceeds dedicated to the Honolulu rail project. Neighbor island governments opposed the tax, saying it would siphon away money visitors would normally spend in the local economy, and it would hit residents off on a “stay-cation.”

So far, there’s little indication that’s happened, but the May 3 volcanic eruption cast a pall on the visitor industry islandwide, making it difficult to determine cause and effect.

“There is no way to quantify this, plus there was too much noise from the volcano that would make it even more difficult to get a sense on this,” said David Givens, general manager of Hilton Waikoloa Village. “However, from January to April, the hotel was ‘rocking’ busy, as was the island, so I don’t think the TAT increase caused any slowdown in visitors or spending.”

It’s likely the Legislature will take another shot this year at some kind of dedicated tax for schools, but at least one lawmaker wants to find a way to spare some of the poorest state residents. Rep. Chris Todd, D-Keaukaha, Hilo, Panaewa, plans to sponsor a bill removing state income tax requirements for those under the poverty line.

“We’re taxing what they don’t have already,” Todd said.