KAILUA-KONA — A federal program could bring new money to parts of Kailua-Kona and Hilo by encouraging investment in low-income communities across the country dubbed Opportunity Zones.

The county is planning two workshops later this month to outline the Opportunity Zones program, created as part of the federal Tax Cuts and Jobs Act signed into law at the end of 2017. The zones are intended to encourage investment in low-income communities by offering tax incentives to investors, who would be able to use the capital gains made off selling an investment they hold and reinvest them into an Opportunity Fund.

Those funds would then invest in businesses located in those Opportunity Zones, providing a potential boon to business owners who might otherwise have a hard time getting investors.

“I work with businesses every day who have trouble getting capital — every single day,” said Dennis Boyd, director of the West Hawaii Small Business Development Center. “And I’m just excited to hear about another resource they can use to try to make their dreams, their businesses become realities.”

The Economic Innovation Group, which promoted the concept of developing Opportunity Zones, estimated that at the end of 2017, investors in the U.S. were holding on to more than $6 trillion in unrealized capital gains that could be invested.

In exchange for investing in an Opportunity Fund, investors get a number of incentives, allowing them to temporarily defer taxes on their initial gains, reduce the amount they can be taxed on and exclude some gains from being taxed entirely.

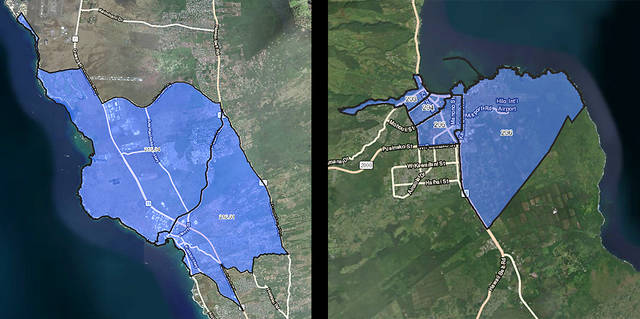

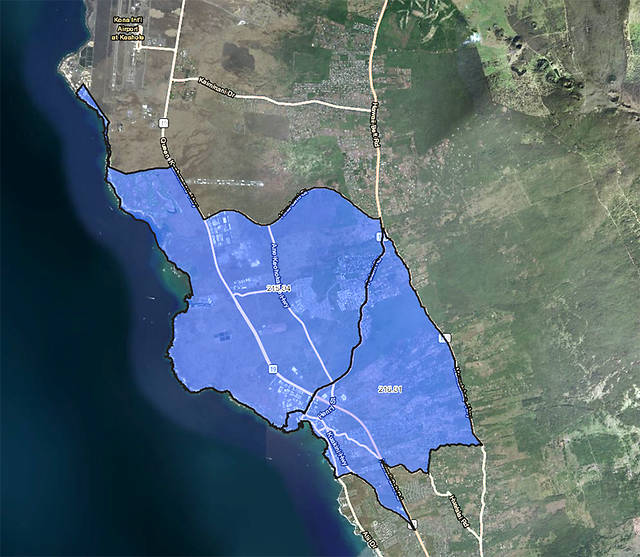

The zones are identified by census tracts and are nominated by the governor for approval by the U.S. Treasury Department. Of the state’s 25 census tracts that have been designated as Opportunity Zones, six of them are in Hawaii County — four in East Hawaii and two in West Hawaii.

Mark Ritchie, branch chief in the Business Development and Support Division within the Hawaii Department of Business, Economic Development and Tourism (DBEDT), said the agency worked with the counties to identify the areas to be designated as Opportunity Zones.

Hawaii County, he said, wanted to focus the program on the island’s primary population areas: Hilo and Kailua-Kona. Because of the way the program is structured, it requires a certain level of current infrastructure and business activity into which investment can be directed, meaning it wouldn’t likely bring a lot of benefit to the most rural areas on the island.

West Hawaii’s Opportunity Zone is made up of two neighboring tracts, identified by DBEDT as Kealakehe, considered a low-income community, and Kailua.

The Kealakehe tract is bordered on the north by Hina Lani Street and part of NELHA and runs south to Palani Road. The zone runs mauka from the coast to approximately the Palani Junction.

According to a demographics report linked to in DBEDT’s map outlining the state’s Opportunity Zones, Kealakehe had a median household income of nearly $59,000 from 2013-17, and more than 11.5 percent of the population was considered to be in poverty.

Meanwhile, the Kailua tract, located immediately to the south of Kealakehe, was also designated an Opportunity Zone. According to a similar demographics report, Kailua had a median household income of more than $71,000 with a little under 7.4 percent of the population in poverty.

Although it isn’t considered “low-income,” it qualified for designation by virtue of being contiguous with the Kealakehe tract.

Ritchie said moving forward, the department’s goal is to support the counties by getting the word out to investors and stakeholders, helping the communities get the most they can out of the program.

The agency won’t, he said, have a role in directing investments or “match making.”

“It’s DBEDT’s role to let potential investors know of the zones and, at a high level, what might be the potential opportunities there in terms of zoning and things like that,” he said. “But we’re not directing people to specific investments. That’s not our role.”

He said they are working on developing fact sheets about the Opportunity Zones that provide high-level snapshots of the potential opportunites for investment in each zone bundled with zoning maps and demographic data.

The first of the county’s two scheduled workshops is scheduled for 8:30-10:30 a.m. Feb. 21 at the Hilo Municipal Golf Course multipurpose room. The second workshop is scheduled for 2-4 p.m. that afternoon in the West Hawaii Civic Center council chambers.

The workshops are free, but attendees are asked to register in advance by Feb. 15.

Each event will include an introduction to the program, an overview of the opportunity zones on the island and a question-and-answer session.

Registration for the Hilo workshop can be found at https://bit.ly/2WFODQx, while registration for the Kailua-Kona workshop is available at https://bit.ly/2GdqtaK.