A handful of Big Island homeowners could face higher property taxes under a county bill that will repeal a 30-year-old county tax ordinance.

Bill 27, which will be introduced Tuesday during a meeting of the Hawaii County Council’s Committee on Finance, aims to repeal a section of Hawaii County code that allowed for a tax exemption for “non-speculative residential use” properties.

The program went into effect in 1991 and allowed property owners to freeze the taxable value of their residential properties for 5-10 years. However, the program was closed to new participants in 2005, and it has existed since then purely to allow a dwindling number of users to renew their exemptions.

Lisa Miura, administrator for the county’s Real Property Tax Office, said there are only 459 parcels in the non-speculative residential use program.

“We’ve had some complaints from people that they feel like they have to renew, to stay in the program,” Miura said. “And also, the Real Property Tax Board of Review last year said the program may be inequitable, since it’s not open to anybody else anymore.”

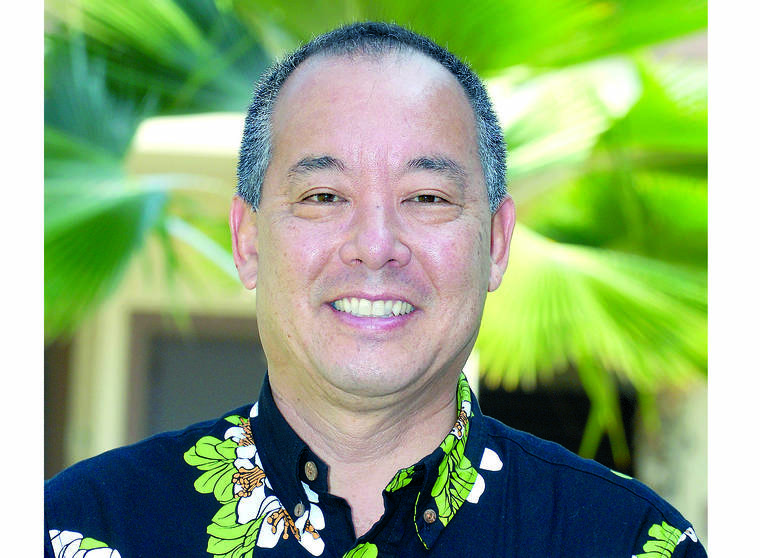

Hilo Councilman Aaron Chung, who will introduce the bill next week, said the county has discussed repealing the program for the past eight years.

Under the non-speculative program, a home’s taxable value is frozen for 5-10 years. Because of this, Miura said participating homeowners were assured that their yearly property taxes would be stable for a prolonged period of time.

But homeowners who failed to comply with the program’s requirements or had to sell their homes would have to pay retroactively applied taxes for each year in the program, plus 10%.

“When people are young, they think they’re invincible, but life changes, and you don’t know where you’re going to be for five or 10 years,” Miura said.

Chung said ending the program will allow homeowners to get out of the long-term commitment of the program without facing penalty.

More than 300 of the properties involved in the program are up for renewal this year, Miura said.

However, Miura said some of the program’s participants are not pleased with the prospect of leaving it.

If the program is abolished, all 459 parcels involved will join more than 40,000 other homeowner parcels on the island whose assessed taxable values can increase year by year, but by no more than 3% per year.

That difference in assessments, Miura said, ended up compelling non-speculative homeowners to remain in the non-speculative program in order to avoid the sticker shock of a higher taxable value.

In order to ease the transition, Miura said the 459 parcels’ values will remain frozen at their current level until 2023.

Email Michael Brestovansky at mbrestovansky@hawaiitribune-herald.com.