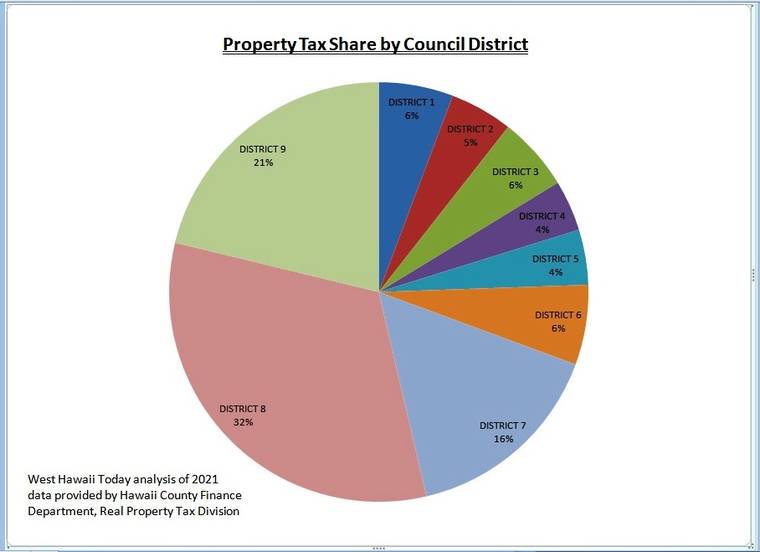

Taxpayers in North Kona’s District 8 shoulder more of the property tax burden than County Council Districts 1-6 combined, as West Hawaii’s property values and concomitant taxes continue to grow with the area’s popularity.

District 8 accounts for 32% of the entire island’s $353.7 million in property taxes, while the three West Hawaii council districts — District 8, Kohala’s District 9 and Kona’s District 7 — together account for about 69% of the county’s tax base.

At the other end of the spectrum are Puna’s District 4 and 5, each contributing 4 percent of the property taxes on the island. Hamakua District 1, Hilo District 2 contributed 5 % and Hamakua District 1, Hilo District 3 and South Kona/Ka‘u District 6 each contribute 6 percent.

That’s according to a West Hawaii Today analysis of current property tax rates applied to the county’s certified property values released Friday by the county Finance Department. Net property values, the amount that is taxed on the island, were certified at almost $37 billion, a 4.9% increase over last year.

The districts are roughly equivalent in population based on the 2010 census. Boundaries are set to be redrawn once the 2020 data arrives later this year.

The property values may end up a little higher, as 250 appeals worth $128.7 million, are still being resolved.

The newspaper did the analysis by aggregating by council district all net property assessments and applying the current tax rates for each of the nine property classes within each district.

The values are important as Mayor Mitch Roth will release his final preliminary budget on Wednesday and the County Council will get to work revising it and deciding whether property tax adjustments are needed for any of the county’s nine property classes.

North Kona Councilman Holeka Inaba said his district’s contribution should bring some returns to the region in terms of county improvements and services.

“It continues to be clear that West Hawaii projects and initiatives are in dire need of prioritization and progress,” Inaba said Friday.

About a dozen taxpayers responding to a crowd-sourced Facebook question posted late Friday were more inclined to say services are lacking, not that their taxes are too high. Road repairs, trash service and county water availability were among the top beefs.

The questions were posed this way: “Do you think your property taxes are too high? Too low? Just right for the amount of county services you get?”

Compared to the mainland, property taxes on the island are low, said several residents, adding they did understand that school taxes are paid on a state level not locally, as is the case on the mainland.

“I think property taxes are ridiculously low but income taxes are ridiculously high,” said District 9 resident Michael Phillips. “With the state income taxes funding schools in place of property taxes, I suppose it’s fair.”

“I don’t like paying any kind of taxes, but I guess my taxes are fair,” said District 6 resident Kristina Anderson. “We get almost no county services here in rural south Kona. No county water, no trash service, bad roads full of potholes that are never repaired, limited transfer station hours and if we have to call cops, fire or EMT it takes them a while to get here.”

Guy Ward pays taxes on property in Districts 1 and 3.

”A good tax should be simple and transparent. The real property tax has potential to be that way but the complexity has increased over the years as politicians have provided for pet constituencies,” Ward said.”I don’t really know, but I suspect that a lot of West Hawaii property is assessed below market. Overall though I do believe that I get my money’s worth. “

James Weatherford, a former County Council candidate, noted the difference in tax rates for agricultural land versus homes. Ag land costs $9.35 in tax for every $1,000 of property value, compared to $6.15 for homeowners.

“Our taxes, in Council District 4, on our ‘homestead ’ are modest, as they should be for a person’s dwelling. On our agriculture land the taxes are higher. Too high? That, of course, depends on what one gets in the way of services,” Weatherford said. “When I was a candidate for Council, I was surprised at the number of people relatively new to the island (HPP, Leilani), who said taxes here are extremely low.”

In addition to the value of the property itself — West Hawaii properties in general have a higher assessed value — factors that play into determining tax values include various county exemptions and new construction that raises property value.

Assessed values for properties in the homeowner class and affordable rental class, not including any improvements, are capped at 3 percent annually until the property changes hands. So districts with a lot of longtime homeowners rather than those who have second homes in Hawaii would see less of an increase in value.

North Kona’s District 8 has a high concentration of hotels and resorts as well as second homes. Those categories not only pay higher tax rates, but they also don’t qualify for exemptions that lower the property values.

The addition of a second property tax tier for non-homeowner residential properties has been estimated in the analysis by applying the percentage of properties each district contains to the approximately $10 million it raised. That shows an approximate, but not a true value.

The second-tier tax, adding $2 in taxes to each $1,000 in property value of $2 million or more, applies only to 935 of the 140,000 properties on the island. It overwhelmingly affects West Hawaii properties, with 55% of the targeted properties located in the North Kona council district, 40% in the Kohala council district and 4% in the Kona council district. The remaining 1% is spread over the remaining six council districts on the island.

Property owners in the residential category, comprising second homes, pay a base tax of $11.10 per $1,000 in property value. Condo and apartment owners not in the affordable rental class pay $11.70 if they don’t have a homeowner’s exemption.

Property exemptions for homeowners also play a role. Homeowners receive an exemption of $40,000. Homeowners aged 60 to 69 receive an $80,000 exemption and those 70 and over receive a $100,000 exemption. Additional exemptions apply for the disabled and disabled veterans.

The County Council has until June 20 to establish tax rates. The budget year starts July 1.

Email Nancy Cook Lauer at ncook-lauer@westhawaiitoday.com.