In an effort to make health care more affordable and alleviate the state’s physician shortage, Grassroot Institute of Hawaii launched a petition urging the Hawaii Legislature to exempt medical services from the state’s general excise tax, or GET.

Grassroot is a nonprofit, nonpartisan research group that does not endorse political candidates or receive funding from local, state or federal governments. The group plans to submit the petition to members of the 2023 Legislature for consideration. The full petition can be viewed here https://tinyurl.com/ye2asvyv

“We have an ongoing doctor shortage, overstressed hospitals and delays in access to care,” said institute President and CEO Keli‘i Akina in a press release. “A GET exemption would cut costs for consumers and make Hawaii a more attractive place for doctors to practice.”

In 1931, Hawaii established a traditional retail sales tax, which was repealed and replaced by a tax on businesses for all transactions, including medical. It started at 1.5% but has risen to 4.71% for Hawaii County as of 2020.

According to a 2021 report from Dr. John Wade, legislative liaison for the Hawaii Physician Shortage Crisis Task Force, the GET generates more than half of Hawaii’s tax revenue.

A business may choose to pass on the GET to its customers, but is not required to do so, because the tax is on the business, not the consumer. Every Medicare, Medicaid, TRICARE and insurance dollar is taxed, making Hawaii the only state in the nation that taxes private practice medical service revenue in this way.

Nonprofits, hospitals and providers like the Hawaii Medical Service Association, or HMSA, are exempt from the GET, leading Wade to refer to the tax as “a private practice killer” in his 2021 report.

“The Legislature has been reluctant to give the relief to the solo and small practice providers, although the hospitals don’t pay it and neither do the federally qualified health centers,” said Lisa Rantz, executive director of the Hilo Medical Center Foundation. “The big institutions say if they had to pay it, it would put them out of business.”

A previous legislative push for GET medical reform took place in 2020, when Senate Bill 2542 proposed exempting physicians and registered nurses acting as primary care providers.

While the Senate passed the bill unanimously, it stalled in the House and was killed on March 17, with Grassroot and Wade’s report citing COVID-19 as a reason for the bill’s failure.

“Typically, if the Senate starts something and sends it over to the House, and they don’t deal with it, we don’t resurrect it,” said Sen. Rosalyn Baker of Maui, who was one of the introducers of the bill. “There are other measures that would need to be considered, and if the House is not interested, we cannot force them.”

Doctors are unable to pass the GET on to Medicare patients, which make up roughly 18% of Hawaii residents with health insurance, according to data from the Kaiser Family Foundation.

“By straddling it on the solo and small practice guys whose margin is so thin, it doesn’t make a whole lot of sense,” said Rantz. “If they didn’t have to pay that, that could potentially lead to more employees, which could generate more income.”

When asked during a livestream on Wednesday if the next elected governor might be able to pass GET reform for medical and food, Gov. David Ige cautioned any changes.

“It’s easy to say as a candidate that that’s a good thing to do,” he said. “But I think those in the Legislature also realize that as you chip away at the general excise tax, where does it end? There’s always a lot of things people think we shouldn’t tax, and as you begin to exempt them, then the excise tax becomes less and less efficient, and you end up raising tax someplace else.”

Big Island doctors also have cited low reimbursements and the high costs of living as other factors behind the shortage of roughly 300 physicians for Hawaii County.

“It’s also a workforce pipeline training issue,” Rantz said. “If we’re training more students, they all have to have clinical rotations, but if you have a physician shortage, who’s there to do the rotation support?”

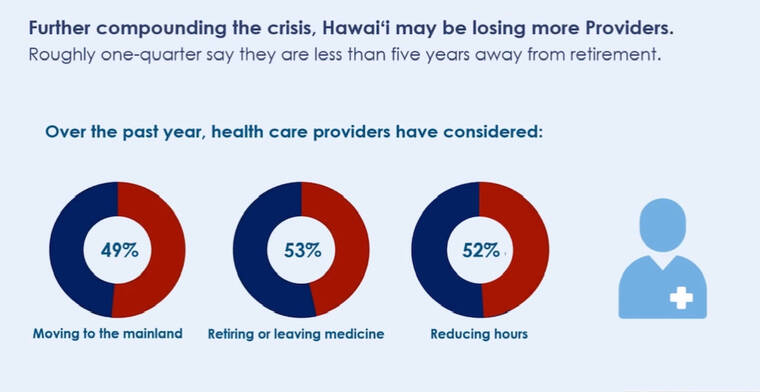

Some doctors have had enough. A 2022 Access to Care Survey from Community First Hawaii reported that of the over 300 health care providers surveyed, 52% contemplated reducing their hours, 53% considered leaving or retiring from medicine, and 49% weighed the option of moving to the mainland.

The survey also found that 82% of Hawaii County residents said they felt there was not an adequate supply of physicians on the island.

“Exempting medical services from the GET would be a major first step toward providing long overdue and much-needed relief,” Akina said. “Hawaii families have been struggling with the rising cost of goods for years, and health care is no different.”

Email Grant Phillips at gphillips@hawaiitribune-herald.com.