County and state measures aim to regulate short-term vacation rentals

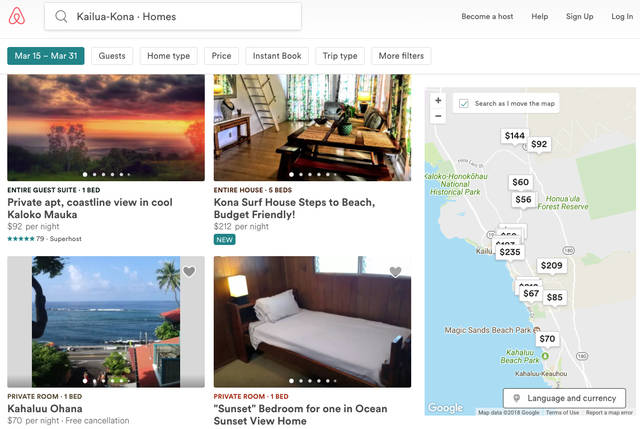

LAURA RUMINSKI/West Hawaii Today The Kona Islander Inn is a popular vacation rental in Kona. There were 8,647 Big Island units advertised on platforms such as Airbnb and VRBO in 2017, a 16.7 percent increase over 2016, according to the Island of Hawaii Visitors Bureau. In contrast, only 2,037 are registered with the state.

Owners of more than 6,000 vacation homes on Hawaii Island are collecting money from short-term renters without registering with the state or paying the required taxes.

Owners of more than 6,000 vacation homes on Hawaii Island are collecting money from short-term renters without registering with the state or paying the required taxes.

That’s according to data compiled by Ross Birch, executive director of the Island of Hawaii Visitors Bureau for a presentation last week to the Hawaii County Council.

ADVERTISING

“It’s almost been a free-for-all,” Birch said, “where there is no reason for someone not to put a secondary home or piece of property or speculation purchase into a vacation rental because there is no penalty.”

There were 8,647 Big Island units advertised on platforms such as Airbnb and VRBO in 2017, a 16.7 percent increase from 2016, according to Birch. In contrast, only 2,037 are registered with the state.

The county and the state are working on several measures to get a handle on short-term vacation rentals, an important first step to ensuring those who rent out their homes are paying transient accommodations and general excise taxes to the state.

The county’s Bill 108 would require existing transient vacation rentals outside of the Vacation District, the General Commercial District or Resort Nodes to apply for a nonconforming use certificate in order to be grandfathered in. Those in the allowed districts would be required to register with the county, but they don’t have to apply to the Planning Department for a nonconforming use permit.

The county bill is on hold until after the Board of Ethics rules on whether North Kona Councilwoman Karen Eoff, one of the co-sponsors, has a conflict of interest because she owns a vacation condo in the Vacation District along Alii Drive. The board next meets March 19.

Matt Middlebrook, Airbnb chief of public policy for Hawaii, said he’s met with a few council members as well as Airbnb hosts on the island. Airbnb has not taken a stance on the bill, he said Monday.

“We’re hopeful that county government listens to those members of the community as well, and their concerns are included in any legislation,” Middlebrook said.

In the state Legislature, Senate Bill 2963 would provide a mechanism for transient accommodations brokers such as Airbnb and VRBO to collect taxes on behalf of the state. It passed the Senate and now is being considered in the House.

Gov. David Ige in 2016 vetoed a similar, but weaker, bill. The latest bill contains enforcement measures that require the internet booking platforms to verify the legality of a vacation rental before doing business with it.

The bill is supported by hotel and lodging associations and tourism agencies.

Three Hawaii County Council members and the county Planning Department supported the bill in testimony.

“While Hawaii County considers its own efforts to address the impacts of short-term rentals, the proposed (bill) provides another tool for the counties to ensure that our residential communities will remain residential and not become single family resorts, and that real property tax rates will be fair and based on actual use,” said Hilo Councilwoman Sue Lee Loy.

It’s opposed by real estate agents, Airbnb and HomeAway/VRBO, which said in testimony that requiring it to disclose the names and license numbers of rental units without a subpoena is contrary to federal law. Over-regulation could result in a loss of tax revenue to the state, they said.

“Instead of trying to eliminate an essential part of the hospitality industry that is woven into the fabric of our economy, the focus should be on finding balance, to create substantial revenue for the state and counties (to fund affordable housing, public facilities, park maintenance, roads and the like), and protection for communities that host visitors,” said Amanda Pedigo, vice president, Government and Corporate Affairs for Expedia Inc., in testimony.

Another bill, House Bill 2605, sponsored by state Rep. Richard Onishi, D-Hilo, and others, would give each county $1 million to set up a registration, property taxation and tracking system for vacation rentals. It’s scheduled to be heard Wednesday by the House Finance Committee.

“We support efforts in Hawaii at the state, and particularly at the county level, to update its laws concerning alternative accommodations in order to adapt to today’s marketplace, while putting in place fair laws that will protect housing stock and neighborhood integrity,” Middlebrook said in testimony.

Email Nancy Cook Lauer at ncook-lauer@westhawaiitoday.com.

Again the ugly demo rat agenda of over tax, over spend and over regulate is destroying families, businesses and the economy. The demo rats failed agenda is in fact causing the very problems they claim to be solving. Further, over regulation and taxation has and will continue to harm everyone including the livelihoods of those that rely on visitor income to feed their families.

Dearing family removed heiau from property they are trying to build on, to speed up process

I didn’t know that people could remove a Heiau from their property.

Wow…is that legal?

This is what happens when angry old white man buys property in Hawaii. Yes…it is illegal. Do you honestly think someone as ignorant as Mr Dearing and his offspring give a f*ck

No.

They may think Karma is just a nightclub.

No one I know would ever disturb a Heiau.

Ever notice how ole Stevie runs his mouth…then when heiau is mentioned….crickets..old angry white boy

Steve I agree with you except for the part about “demo rats”. As soon as you said that you lost all credibility in the eyes of many. It shouldn’t matter whether you vote red or blue because this will affect us all.

It is the crooked demo rats and their corrupt agenda that has no credibility. Along with their racist agenda that is bleeding the life blood out of this state. For the record, demo rats are the enemy within and the cowardly, scumbags Icans run like diarrhea so the red and blue nonsense came from you.

here we go again……year after year after articles after government and after already passed laws.

YEARS….this has been going on and every time UNENFORCEABLE for some reason or another.

MILLIONS of Tax dollars collected and NOT Remitted….Buildings that would NEVER pass a building inspectors even casual eye.

It is somehow Easier to RAISE Taxes than to enforce Current Law.

Not ver fair to the owners of rentals that Obey the Law and remit their collected taxes.

Not very fair to the Legal Operators that have to compete with those that circumvent.

Year after year this has gone on.

I expect more of the same at this point.

Ige and Kim are great at spending money and raising taxes …. not good at all about administering Existing Law.

Stick it in your pockets folks…we Legal owners and tourists will pay MORE taxes so you can continue to avoid.

Hi Volcanovillage, yes, exactly. B&B owners and operators who went through all the effort to get certified are right to be angry about the current situation. Think about this: A bed-and-breakfast is subject to a pages of county legislation, from fire code to getting a license, while an owner listing a house on AirBnB is not.

Alex, I think it’s interesting how you seem to be on every piece of news I can find about this issue pushing your so called “facts”. Are we supposed to believe you have no agenda here? I’m guessing you’re either being paid by these crooked politicians to push this nonsense or you are one of these crooked politicians. Either way, you have no credibility with me and I hope the rest of my fellow Hawaiians see this too.

First of all I find this article incredibly bias and second these numbers have been produced by people who are simply trying to push their own agenda and should not be taken as fact. In addition I think you’re missing the point which is that their agenda is to push most vacation rental owners (yes, you included) out of the market completely so they can push that money to the resorts and the people rich enough to build in these so called “resort zones”. It’s just another tactic to make the rich richer and keep the poor poorer. They couldn’t care less about the people of Hawaii or the rights of homeowners. I say we vote them all out! A vote for a bill that takes rights away from citizen’s and gives them to corrupt politicians is just another vote for Trump.

Mitch, nope, no connection to politics. I am simply passionate about vaca rentals being abused by a new class of people that live off-island and own several rentals here. In my neighborhood, there are several. And I don’t think that is OK. I support any vaca rental owner that actually lives on-island and has no more than one or two units. Everything else is business, not family use, and it does not belong into residential neighborhoods. We may also need to regulate it in resort zones, but less so. That’s all I have to say. You are of course entitled to your own view on the issue. Let the best arguments win.

Okay Alex, can you provide a valid non-biased resource for which you’re basing the above “facts”?

Hi Mitch, do you doubt that there are many owners who live off-island, except for maybe one or two months a year, and who have more than one housing unit listed?

All of it. The number of vacation homes, the number of owners paying taxes, the number registered. These statistics are numbers you and your employers (the resorts?) have simply made up. There’s no non-biased person collecting actual data on this. I love how you “answered” a question with another question though, not actually answering anything. Spoken like a true politician.

I have no connection to the resorts or politics and I am not drawing a salary from anyone. Those people exist, believe it or not 🙂

There is no such thing as unbiased data in the eyes of people whose income depends on the data not being recognized as valid.

So what you’re saying is that you can’t provide any valid facts to support your opinion? So without any actual evidence that any of this is true you’re just going along with it? So much so that you need to comment on every piece of media about the subject simply because “you’re passionate about the issue”? Please tell me, how does someone become “passionate” about something without actually knowing anything about that said thing? I wasn’t born yesterday. Sorry, try again.

Mitch, which claims are you disputing? Please take just one single claim you disagree with, not “all claims”, because the issue is quite complex. We have to divide and conquer, otherwise we never finish

Please read the above comments. I understand answering multiple questions can be difficult but could you just answer at least one of them?

Mitch, having problems with disqus. Somehow can’t post, All my posts go to “Hold on, this is waiting to be approved by Hawaii Tribune Herald”. This seems to happen whenever I include a link (for citation/source.) May need to move the discussion somewhere else.

Ryan Lee Henry REALTOR®; Licensed at HomeSmart Platinum Living

Bill 108 is bad news for Hawaii County and will dramatically affect tourism, jobs and real-estate values. Hotels in all of the Hawaii islands are very expensive, short term rentals make it affordable to vacation on Hawaii Island. Take them away and the tourists will go to Maui, Kaui and Oahu where they will likely still exist. No tourists, no jobs.

Many, many home owner associations already Disallow short term rentals through their CC&R’s. Folks can simply purchase in those neighborhoods if they don’t like short term rentals. Property owners have the right to put their property to the “highest and best use” and taking away this right is illegal.

Many retirees and others use their property part of the year and rely on income from short term rentals the rest of the year to help cover their mortgage payment and taxes. Take them away and most will have to sell. More inventory means a huge drop in real estate values for everyone which means less taxes for local government and less funding for programs.

Bill 108 is provincial and not well thought out. Cities, towns, and counties throughout the free world allow them as they know are good for business. There will be lawsuits if this bill passes counting the county millions. People have property rights and Bill 108 is in clear violation of them.