The Hawaii County property tax office is being deluged with phone calls following mailings this week to more than 40,000 property owners telling them about a new ordinance that requires them to file state income taxes in order to qualify

The Hawaii County property tax office is being deluged with phone calls following mailings this week to more than 40,000 property owners telling them about a new ordinance that requires them to file state income taxes in order to qualify for their county homeowner’s exemption.

“There really have been a lot of phone calls,” Deputy Finance Director Lisa Miura said Friday.

Miura said “hundreds but not a thousand” people have called the office after the letters began arriving in their mailboxes. She anticipates even more calls next week.

The letters follow a change to the county code effective Dec. 31. The new ordinance, recommended by a task force and passed by the County Council, is a way to plug loopholes in the county code that lets people get significant homeowner tax breaks without proving the property is their principal residence.

The county won’t see the state tax return, but will use the last four digits of the homeowner’s Social Security number and date of birth to compare the list of homeowners taking the exemption against the state list of taxpayers.

There are two types of letters. One sent to 37,000 people informs them that their county property tax exemption request will be compared against a state Department of Taxation database to ensure that they are indeed residents.

People receiving this letter who file Hawaii state income tax forms need do nothing. Those who don’t file a Hawaii state income tax form, for example if they are new residents or they are below the income threshold, must submit a waiver to the county explaining why they don’t file state tax forms.

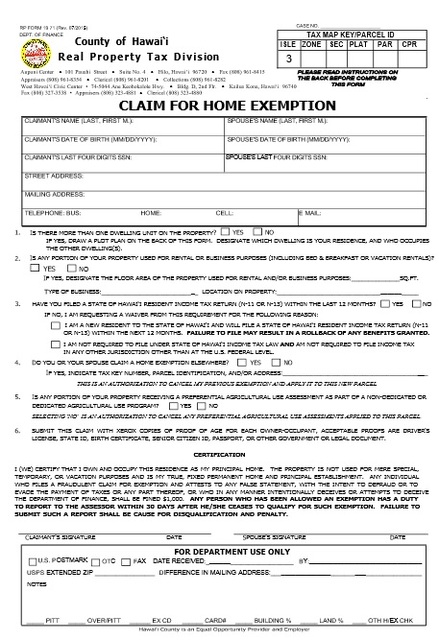

The other letter, sent to 4,100 people, informs them that their Social Security number or date of birth is not in the file. These homeowners must submit a new claim for a homeowner exemption by Dec. 31 or risk losing their homeowner’s exemption next year. The claim form is included with the letter.

Kohala Councilwoman Margaret Wille, who chaired the task force of residents, county staff and council members who recommended the bill, said she’s pleased the new policy is finally coming to fruition.

“You’re either a resident or you’re not,” Wille said Friday. “A lot of people who were not residents were taking advantage of it, and all of us residents were paying more taxes.”

Still, she said, the letter could have better explained why the changes are being made.

“I always feel things should be explained a little more,” Wille said of the letter, which was steeped in officialdom and legal language. “It gives you the feeling no matter who you are, your homeowner’s exemption is being questioned.”

People who have questions about their letters can call the property tax hotline at 961-8900.

Waimea attorney Bill Hastings, who frequently provides input on property tax issues, said Friday that he thought the letter was straightforward enough. Both Wille and Hastings received the letters that went out to the larger group whose Social Security numbers are already in the system.

Hastings, however, has an issue with the tax system itself.

He thinks the homeowner’s exemption should be done away with, in favor of a more equitable rate that taxes everyone something, and is based on the value of the property. If the county wants to encourage conservation, why tax conservation land, he asked. If agricultural land is a premium, then don’t tax it to the extent the landowner would be better off developing it, he added.

“It’s the people who create the burden on government services; it’s not the land,” Hastings said. “I’ve long thought the property tax system is upside down.”

Hastings sees the homeowner’s exemption as generous.

Property owners claiming the homeowner’s exemption get $40,000 of property value deducted from their assessment, plus 20 percent of the assessed value not to exceed $80,000, thus lowering their tax. The deduction increases for seniors, the disabled and veterans. A property owner older than 60 gets an $80,000 exemption, older than 70 gets a $100,000 exemption. There’s an additional $50,000 exemption for disabled property owners.

The exemptions apply against the value of the property, but there is a minimum tax, typically $100 annually, for those properties that fall to the minimum assessed value.

Checking the homeowner’s exemption list against vital records and tax returns was one of 40 recommendations for the county in a 99-page March 2012 report by the International Association of Assessing Officers. The property tax task force was another.